Indonesia Import Procedure Explained

Indonesia ImportProcedure Explained for any goods coming from overseas into the Indonesian

customs territory are treated as “import” and are generally subject to customs

duty.

Indonesia Import Procedure of goods into Indonesia is subject to customs

verification, i.e. verification of documentation and physical inspection of

goods.

Importation of goods

into Indonesia must be declared to the Customs Authority using an Import

Declaration Form (PIB). To be able to fulfill customs obligations, the importer

must register with the DGCE to obtain a Customs Identification Number (NIK). Customs

duty and import taxes payable should be settled first before the goods are

released from the customs area (airports and harbors). If the deadline is not

met, the customs duty payable is subject to an administrative penalty of 10%

from the customs duty payable.

Requirement for Indonesia import procedure

An importer can be a

person or company, whether it has legal entity status or not. An importer must

have a Customs Identification Number (Nomor Identitas Kepabeanan, NIK) and an

Importer Identification Number (Angka Pengenal Impor, API). Importation of

certain products requires the importer to have a Special Importer

Identification Number (Nomor Pengenal Importir Khusus, NPIK) or Registered

Importer Number (Importir Terdaftar Produk Tertentu, ITPT). All importer must

have these license to completing the Indonesia

import procedure

Customs Identification Number (NIK) to completing Indonesia import procedure

NIK must be obtained

from the DGCE and will remain valid unless it is cancelled by the DGCE.

Importer Identification Number (API)

All importers must have

an API. Currently there are two types of API as summarized in the table below:

The API is valid for

five years and can be extended. It is applicable for the entire Indonesian

customs territory.

Starting January 2011,

API-P holders may also import finished goods to support their business

activities, subject to certain criteria or requirements.

Importation without an

API can only be done after obtaining approval from the Indonesian Minister of

Trade (MoT) and only for infrequent importation of self-consumed goods (not for

trading purposes).

Special Importer Identity Number (NPIK) other requirement for Indonesia

import procedure

NPIK should be obtained

by companies that import certain commodities such as rice, electronic products,

sugar, corn, soybeans, toys, footwear, and textiles. The NPIK can be obtained

from the Ministry of Trade by an importer that already has an API, and is valid

for five years.

An importer that holds

an NPIK should file a written report regarding its import realization to the

Ministry of Trade on.the 15th of every month.

Registered Importer Number (ITPT) other requirements for Indonesia

import procedure

Certain products can only

be imported by a Registered Importer of Certain Products (Importir Terdaftar

Produk Tertentu, ITPT). The current list of certain products that can only be

imported by ITPT is as follows:

-

electronic products;

-

ready-made garments

-

toys

-

footwear

-

food and drink products

-

cosmetic products; and

-

traditional and herbal medicines

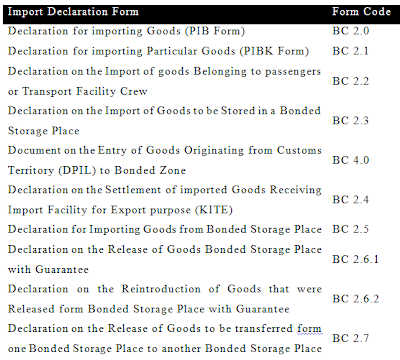

Customs Declaration Forms

1.

The Importer must prepare a Customs Declaration

Form (PIB) upon the importation of goods.

2.

The customs declaration should be accompanied by

supporting documents, i.e. commercial invoice, airway bill (AWB) or bill of

lading (B/L), packing list (P/L), insurance letter, etc.

3.

Revision of an import declaration can be done

under certain circumstances. Revision can be made to an import declaration,

provided the imported goods have not been released from the temporary customs

area, the error was not discovered by the customs officials, and no assessment

has been issued.

4.

The type of import declaration form depends on

the purpose of the importation, as follows:

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

General Procedure of Importation

The procedures of importation are as follows:

1.

Arrival of transportation vehicle (ship,

airplane, etc.)

Before

the arrival of a transportation vehicle from outside the customs territory, the

carrier must notify the Customs Office of the planned arrival of the vehicle.

2.

Arrival of Import Goods

Upon

the vehicle's arrival, the carrier must submit a customs declaration, i.e.

manifest, to the Head of the Customs Office within 24 hours after the arrival

of the ship (eight hours for aircraft; immediately for land transport), in Indonesian

or English, signed by the carrier.

3.

Discharge of Import Goods

The

import goods shall be discharged at the customs area or other place after

receiving approval from the Head of Investigation or authorized officer. The

carrier shall provide a list of the containers or break bulk amount which has

been discharged to the authorized officer at the Customs Office, either

manually or electronically, this is part of Indonesia import procedure

4. Procedure

for Clearance / Release of Import Goods from Customs Area.

-

The importer shall complete and submit the PIB,

compute the customs duty and import taxes, and make payment to the depository

bank;

-

The PIB and its attachments, such as commercial

invoice, P/L, B/L / AWB, customs duty and import taxes payment evidence, etc.,

are submitted to the Customs Authority for approval;

-

The import goods can be released from the

customs area after approval by the Customs Authority.

5.

Computation of Customs duty and import taxes

- Customs Duty = Customs duty tariff x CIF Value

(Cost, Insurance and Freight) If the insurance and freight are unknown, the

DGCE provides guidance to calculate the deemed amount based on a percentage.

-

Value Added Tax = 10% x [CIF Value plus customs

duty]

-

Article 22 Income Tax = Tariff x [CIF plus

customs duty]

-

The tariff of article 22 income tax is 2.5% for

API holder and 7.5% for non-API holder.

-

Luxury Goods Sales Tax (LGST) = Tariff x [CIF

Value plus customs duty] LGST is only imposed on certain goods that are defined

as luxury goods.